Despite having a healthy bank account and steady income, you still check your balance obsessively and feel guilty buying the good olive oil—because that scared kid who watched your parents stretch every dollar is still secretly running your financial decisions.

Ever catch yourself checking your bank balance multiple times a day, even though you know there's plenty in there?

I do this constantly. My partner thinks it's hilarious that I still get anxious before clicking "submit" on an online purchase, despite having a healthy emergency fund and steady income. But old habits die hard, especially the ones we picked up when money was tight.

Growing up in a middle-class suburb with high-achieving parents, I watched them stretch every dollar while maintaining appearances. College meant taking on crushing student loans that haunted me until I was 35. Even after landing a high-paying finance job, those early money anxieties never fully left.

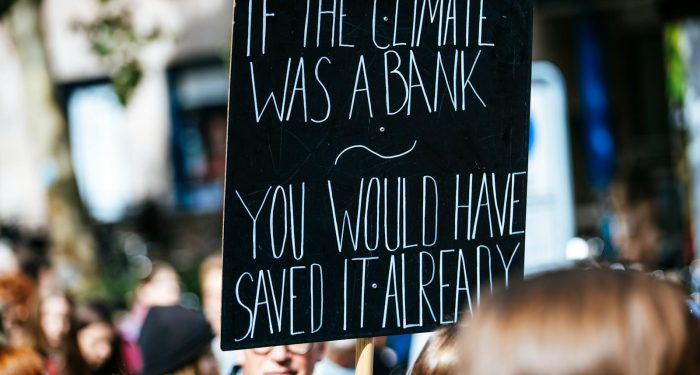

The fascinating thing? Many of us who grew up with financial uncertainty carry these fears long after we've achieved stability. We've rewired our careers, built our savings, created the security we once craved, yet somewhere deep down, that scared kid who worried about money is still calling the shots.

If you find yourself doing mental gymnastics every time you spend money or hoarding resources "just in case," you're not alone. These eight irrational fears might sound eerily familiar.

1. Believing every purchase needs to be justified

Remember having to explain why you needed new shoes when the old ones "still worked"? That voice still echoes in my head every single time I buy something.

Last week, I spent twenty minutes in the grocery store debating whether to buy the fancy olive oil or the regular one. The difference? Three dollars. My brain immediately launched into a full presentation about why I didn't really need the good stuff, how the cheap one was perfectly fine, and what else that three dollars could go toward.

This mental courtroom drama happens whether I'm buying a coffee or booking a vacation. Everything needs a defense attorney. "I deserve this because I worked hard this week." "This will save money in the long run." "It's an investment in my health."

The truth is, when you're financially stable, you don't need to justify every purchase to an imaginary jury. Sometimes you can just buy the nice olive oil because you want it. Revolutionary concept, I know.

2. Panicking when unexpected expenses arise

My car needed new brakes last month. Cost me $400. I have thousands in my emergency fund specifically for things like this, yet my first reaction was pure, primal panic.

That familiar stomach drop, the racing thoughts about what else might break, the immediate mental inventory of what I could cut from my budget. All this despite having more than enough money to cover it ten times over.

When you grow up watching your parents stress over every car repair or broken appliance, your nervous system gets programmed to treat unexpected expenses like genuine threats. Your rational brain knows you're fine, but your body hasn't gotten the memo.

I've started telling myself, "This is exactly why I have savings." Simple, obvious, but surprisingly effective at calming that automatic panic response.

3. Feeling guilty about not choosing the cheapest option

There's a special kind of guilt that comes from picking the middle-shelf wine instead of the bottom one. Or choosing the direct flight instead of the one with two layovers that saves fifty bucks.

I spent years in finance making excellent money, yet I'd still feel physically uncomfortable ordering anything but the cheapest entree at restaurants. My brain would calculate what percentage of my old grocery budget this meal represented, even though those days were long behind me.

This guilt is like carrying around a scorecard from a game you're no longer playing. You won the financial stability game, but you're still following the old rules. Learning to spend according to your current reality rather than your past circumstances is surprisingly difficult.

4. Hoarding resources "just in case"

My freezer looks like I'm preparing for an apocalypse. Bulk packages of everything, backup supplies for my backup supplies. I tell myself it's practical, but really, it's fear.

Do I need seventeen tubes of toothpaste from that sale? No. But what if they stop making this brand? What if prices go up? What if, what if, what if.

This scarcity mindset extends beyond physical items. I hoard vacation days, afraid to use them. I keep old clothes that don't fit "just in case." I save every plastic container because "you never know when you might need it."

When you've experienced not having enough, your brain becomes hypervigilant about preventing that feeling again. Even when your closets are bursting and your pantry is full, that part of you that remembers scarcity keeps whispering, "But what if it runs out?"

5. Avoiding looking at bills or bank statements

For someone who worked in finance, I have a ridiculous relationship with my own financial paperwork. I know exactly what's in my accounts, yet opening those statements still makes my heart race.

It's like my nervous system is stuck in the past, when checking the balance meant potential bad news. When every bill was a source of stress. Now I have autopay set up for everything and plenty to cover it all, but that envelope from the credit card company still makes me want to hide it in a drawer for a week.

The avoidance becomes a habit. You know you're fine, but looking at the numbers feels like tempting fate. What if you miscalculated? What if there's a charge you forgot about? The anxiety of not looking becomes preferable to the anxiety of looking.

6. Believing financial security could vanish overnight

Three years. That's how long I saved aggressively before leaving finance. I had spreadsheets, projections, backup plans for my backup plans. Still, I was convinced it could all disappear in an instant.

This fear of sudden poverty makes you play it too safe. You stay in jobs you hate because at least they're stable. You don't invest properly because what if you lose it all? You make decisions from a place of fear rather than opportunity.

When I finally left my finance job, I had to confront the identity I'd built around being financially successful. Turns out, that identity was mostly about proving I'd never be financially vulnerable again. But living in constant fear of loss isn't really living at all.

7. Comparing prices obsessively

I once spent an hour researching paper towel prices across four different stores to save two dollars. An hour of my life for two dollars.

The mental math never stops. This shirt is $30, which is two hours of my old minimum wage job, which could buy fifteen pounds of rice, which could feed me for weeks. Every purchase gets filtered through past financial frameworks that no longer apply.

You find yourself checking three websites before buying anything, reading every review, hunting for coupon codes like your life depends on it. The time and mental energy spent trying to save small amounts of money becomes its own kind of poverty, even when you can afford to value your time differently.

8. Feeling like you don't deserve financial comfort

This might be the strangest one, but it's real. Sometimes I catch myself thinking I'm not the "type" of person who should have financial security. Like it's meant for other people, and I'm just temporarily borrowing it.

You downplay your success, attribute it all to luck, and wait for someone to realize you don't belong here. Imposter syndrome meets financial trauma, and suddenly you're apologizing for having a savings account.

Final thoughts

These fears served a purpose once. They kept you careful when you needed to be, motivated you to build security, helped you survive lean times. Honoring that while learning to let go is the tricky balance.

I'm getting better at it. Sometimes I buy the expensive olive oil without the mental trial. Sometimes I book the direct flight without calculating hourly savings. Baby steps toward believing that financial stability isn't a fluke or a temporary state.

If you recognize yourself in these patterns, be gentle with yourself. These fears are trying to protect you from a danger that no longer exists. Thank them for their service, then slowly teach them that it's safe to stand down. You've built the security you needed. Now comes the harder part: learning to actually feel secure.

If You Were a Healing Herb, Which Would You Be?

Each herb holds a unique kind of magic — soothing, awakening, grounding, or clarifying.

This 9-question quiz reveals the healing plant that mirrors your energy right now and what it says about your natural rhythm.

✨ Instant results. Deeply insightful.