From hoarding broken toasters to feeling guilty about buying yourself lunch, these deeply ingrained patterns from a cash-strapped childhood continue to control your adult life in ways you've probably never connected to your past.

Growing up without money shapes you in ways you don't always realize.

I've been thinking about this a lot lately, especially after visiting my grandmother who raised four kids on a teacher's salary. She still volunteers at the food bank every Saturday, and watching her there reminded me how deeply our childhood experiences with money affect who we become.

The fascinating thing? Most of us who grew up with financial struggles carry certain behaviors into adulthood without even noticing them. These patterns run so deep they feel like personality traits rather than learned responses.

Today, let's explore eight behaviors that tend to stick with people who grew up with very little money.

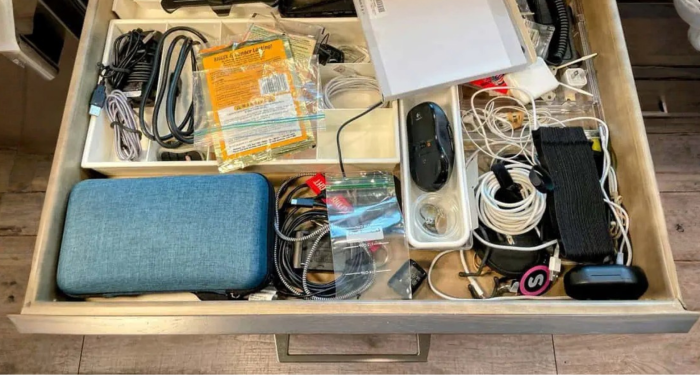

1. You keep way too much "just in case" stuff

Ever catch yourself holding onto that broken toaster because "maybe it can be fixed"? Or keeping those worn-out shoes because they might come in handy someday?

When you grow up in a household where replacing things isn't always possible, you learn to keep everything. That half-empty bottle of shampoo? The old phone charger that only works if you hold it at the right angle? They all stay.

This behavior often continues even when your financial situation improves. Your closets become museums of "might need this later" items. You know rationally that you could buy a new one if needed, but that childhood voice whispers that throwing anything potentially useful away is wasteful.

The irony is that this habit can actually cost you more in the long run through storage costs, clutter-related stress, and missed opportunities to donate items others could use right now.

2. You feel guilty about spending money on yourself

Does buying something nice for yourself trigger an immediate wave of guilt? You're not alone.

People who grew up watching their parents sacrifice constantly often struggle to justify personal purchases. Even when you've earned the money yourself, even when bills are paid and savings are growing, that guilt persists.

You might find yourself mentally calculating how many groceries that new jacket could buy, or thinking about how your parents never had such luxuries. The purchase feels selfish, indulgent, wrong somehow.

This guilt can extend to experiences too. Taking a vacation? Going out for a nice dinner? The internal struggle is real, and you might find yourself making excuses or downplaying these choices to others.

3. You stockpile food and household essentials

Walk into my pantry and you'd think I'm preparing for the apocalypse. Five tubes of toothpaste, enough rice to feed a small army, and don't even get me started on the canned goods situation.

When you've experienced empty cupboards as a kid, a full pantry becomes emotional security. Sales trigger a primal response to stock up. Buy one get one free? Better grab four.

This behavior makes perfect sense from a scarcity mindset. Running out of something essential was a real fear growing up, and that fear doesn't disappear just because your bank account looks healthier now.

Friends might joke about your "prepper tendencies," but for you, those extra supplies represent safety and control.

4. You have complicated feelings about money conversations

Money talks can swing between two extremes for those who grew up poor. Either you avoid them entirely, or you're hyperaware of every financial detail.

Some of us learned that money conversations meant stress, arguments, or shame. We internalized the message that discussing finances was uncomfortable, private, or embarrassing. Now as adults, we might dodge salary negotiations, avoid financial planning discussions, or feel physically uncomfortable when money comes up.

Others went the opposite direction, becoming almost obsessed with financial transparency and planning. Every purchase is discussed, every penny tracked, because knowledge feels like protection against returning to those uncertain times.

Neither extreme is inherently wrong, but recognizing where these patterns come from can help us find a healthier middle ground.

5. You struggle to accept help or gifts

When someone offers to pay for lunch or gives you an expensive gift, what's your first reaction? If it's discomfort, you might be carrying this common trait.

Growing up with little money often means growing up proud and self-reliant. Your family might have emphasized never being a burden, never taking charity, always pulling your own weight.

Now when someone genuinely wants to treat you or help you out, it feels wrong. You might insist on paying them back, feel obligated to reciprocate immediately, or simply refuse the gesture altogether.

This can strain relationships and rob others of the joy of giving. It also reinforces the belief that you must earn or deserve everything, rather than sometimes simply accepting kindness.

6. You overwork and undervalue your time

How often do you take on extra shifts, freelance projects, or side hustles even when you don't desperately need the money?

When you grow up seeing adults work multiple jobs just to survive, rest feels like luxury you can't afford. The idea of turning down paid work seems irresponsible, even when you're exhausted.

This extends beyond formal work too. You might struggle to hire help for things you could technically do yourself. Paying someone to clean your house or fix something feels wasteful when you could save that money by doing it yourself, regardless of the time cost.

The problem is that this mentality can lead to burnout and actually limit your earning potential by leaving no time for skill development or strategic career moves.

7. You have an complex relationship with quality

Here's something interesting I've noticed: people who grew up poor often swing between buying the absolute cheapest option and occasionally splurging on something wildly expensive.

The cheap purchases come from years of training that the lowest price is the only responsible choice. But then sometimes, especially for items that failed repeatedly in childhood due to poor quality, you might overcompensate by buying the most expensive version you can find.

Those childhood experiences with shoes that fell apart, appliances that constantly broke, or cheap food that never quite satisfied create lasting impressions. You might save obsessively for the "good" version of specific items while still buying generic everything else.

Finding balance between quality and cost remains a constant internal negotiation.

8. You prepare for disaster constantly

Do you always have an exit strategy? Multiple backup plans? A mental catalog of what you'd do if you lost your job tomorrow?

Growing up with financial instability means growing up with uncertainty. When stability wasn't guaranteed, you learned to expect and prepare for the worst.

This might manifest as excessive emergency funds (nothing wrong with being prepared, but some of us take it to extremes), reluctance to make long-term commitments, or constant low-level anxiety about losing what you've built.

You might find yourself unable to fully enjoy success because you're waiting for the other shoe to drop. That promotion, that new house, that growing savings account all feel temporary, like they could disappear as quickly as they came.

Wrapping up

If you recognized yourself in these behaviors, you're definitely not alone. These patterns served a purpose once, protecting us and our families during difficult times.

The challenge now is recognizing which behaviors still serve us and which ones hold us back. Some habits, like being mindful of spending, remain valuable. Others, like chronic overwork or inability to accept help, might be worth examining and adjusting.

Understanding where these behaviors come from is the first step. They're not character flaws or weaknesses. They're adaptations, proof of resilience, evidence of what you've overcome.

And honestly? In a world that often glorifies excess and waste, some of these "poor kid" habits might just be the wisdom we all need.